Egosystems to Ecosystems | From 'Me' to 'We'

From 'Me' to 'We'

Back in the heady ’90s,

Wall Street’s Gordon Gecko character became the ultimate poster-boy for unbridled capitalism, spurring an influx of ambitious Gecko-wannabes into the investment world. In the 2010 sequel, Gecko wants to start over, but ultimately finds himself edging back into play — old habits die hard. As he leaves prison having served time for insider trading, the reformed corporate raider reflects ‘S

omeone reminded me I once said “Greed is good”. Now it seems it’s legal. Because everyone is drinking the same Kool Aid .”

In 2022, the shameless pursuit of self-interest is not only legal, it has become an industry in, and of, itself. The ‘me above you’ approach to business has become so deeply woven into our social fabric that we rarely question it. We see it reflected in our social media, in the rise of influencer marketing, and in mounting collective narcissism. We see it when tech investors and stock markets demand relentless and aggressive growth in engagement metrics. We see it when corporations make short term decisions that benefit shareholders at the expense of employees, customers, or society at large. And we see it in the concentration of wealth and the race for global domination of the world’s data.

How Did We Get Here?

Just over 50 years ago, in September 1970, leader of the Chicago school of economics Milton Friedman published the ‘Friedman Doctrine’ in the

New York Times . In it, he put forward the argument that ‘

the social responsibility of business is to increase its profits’ . The Friedman Doctrine was significant because of its foundational declaration that ‘

a corporate executive… is the agent of the individuals who own the corporation… and his primary responsibility is to them’ . According to the doctrine, the only metrics that matter are financial, and the shareholder is the ultimate customer. Friedman’s doctrine became the normative business model throughout the 80’s, fuelling the ‘greed is good’ mantra of

Wall Street and real-life financial markets.

Friedman went on to win the Nobel Prize in Economics in 1976, and has been described by The Economist as “

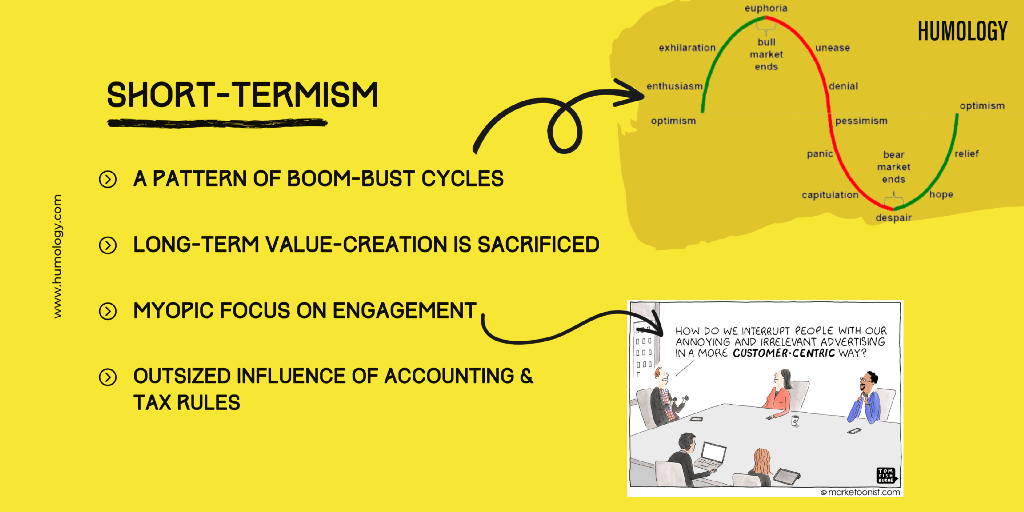

the most influential economist of the second half of the 20th century…possibly of all of it ”. Since then, the dot-com crash in the early ’00s and the financial crisis of the late ’00s have provided some hints that the ruthless pursuit of profit maximisation is not sustainable in the longer term, but the boom-bust cycle has done little to quell the appetite for more — more money, more sales, more attention, more engagement, more growth, more data and so on.

In a world where investors and venture capitalists demand hockey stick growth charts from their portfolio of investments, it’s easy to lose sight of what matters most: humanity itself. Growth metrics and external market expectations have historically swayed product decisions and have an outsized impact on internal decision-making. Aza Raskin, the designer behind the addictive infinite scroll feature, outlines the daily dilemma for many product teams. “

In order to get the next round of funding, in order to get your stock price up, the amount of time that people spend on your app has to go up ,” he said in an interview with

BBC News “

So, when you put that much pressure on that one number, you’re going to start trying to invent new ways of getting people to stay hooked.”

The result is a hyper-competitive marketplace chasing a growth-at-all-costs strategy. The mantra of ‘greed is not only good, it’s legal’ has enabled too many tech CEOs to turn a blind eye when faced with a raft of unintended consequences and externalities.

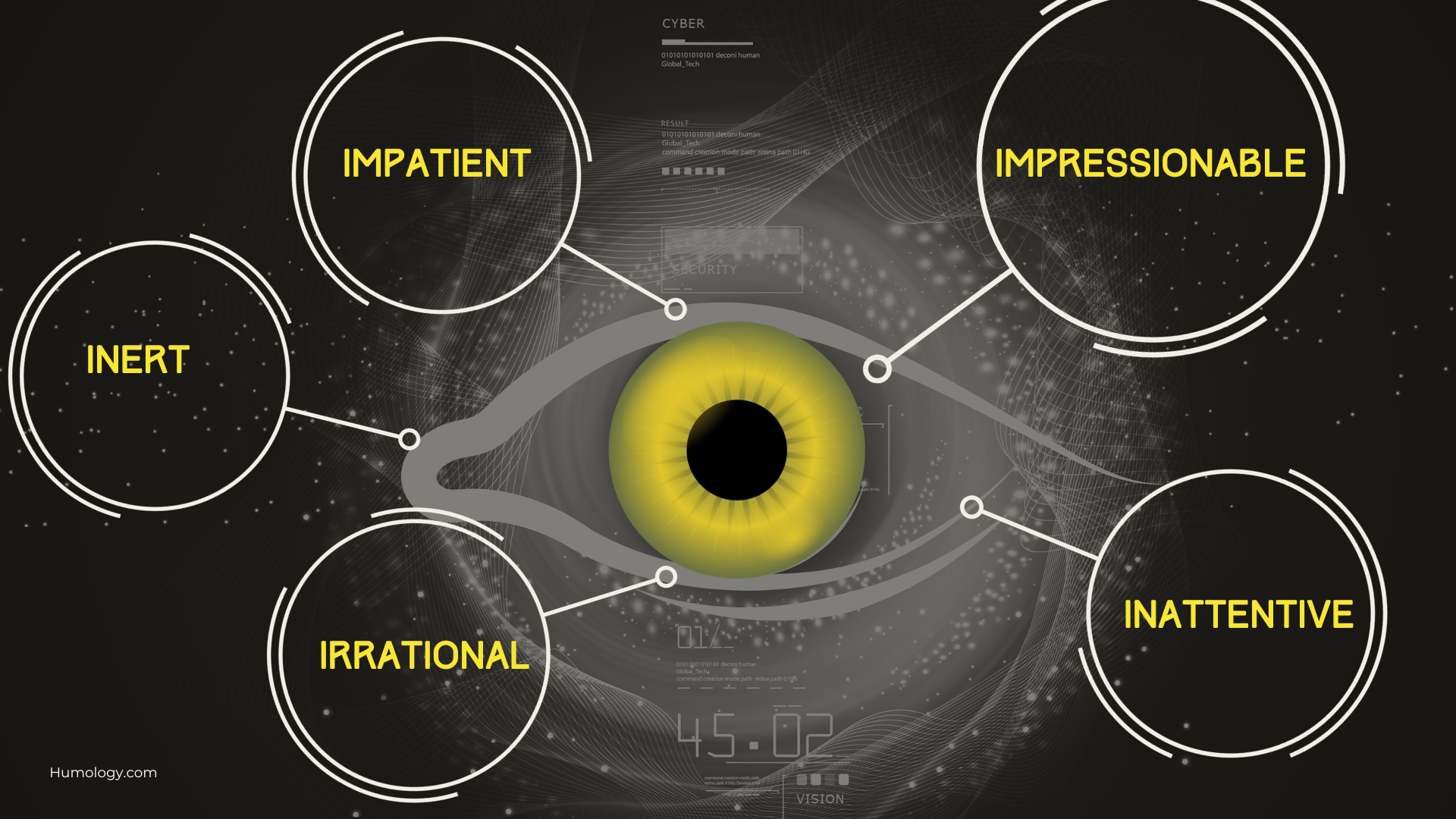

We Are Myopic By Design

Humans are the ultimate Masters of Convenience — over the past 10 years we have turned our smartphones into our very own genie in a bottle. And while we’re hardwired for convenience, we’re also engineered for instant gratification and impulsivity. Our brains are simply not designed to make long-term decisions — always preferring sooner than later, and certainty above risk. This

temporal myopia ensures that short-termism creeps into every aspect of our lives and the institutions we create. In a Washington post op-ed following the global financial crisis, former Chair of the US FDIC (

Federal Deposit Insurance Corporation), Sheila C. Bair warned of a growing obsession with short-termism — ‘

The common thread … is a pervasive and persistent insistence on favouring the short term over the long term, impulse over patience. We overvalue the quick return on investment and unduly discount the long-term consequences of that decision-making’

Not only do we engage the

Ostrich effect when thinking about the future, we also make key business decisions that benefit the near-term at the expense of the longer-term. The more short-term a corporation is, the less likely they are to have breakthrough inventions or innovation, as evidenced by the low number of patents registered by these businesses. A short-term focus makes us less tolerable of risk. In his 2015 Letter to CEOs, Blackrock’s Larry Fink stated that ‘

more and more corporate leaders have responded with actions that can deliver immediate returns to shareholders … while underinvesting in innovation, skilled workforces or essential capital expenditures necessary to sustain long-term growth ’.

In

Net Positive , the authors argue that leaders need the freedom and opportunity to solve big challenges, which can take many quarters of hard work. We cannot tackle climate change or growing inequality while dancing to the beat of quarterly reporting. Creating long-term value means not shooting for the moon in a given year, but investing every year to get the compounding effects and benefits of consistency over time

Expanding Our Horizons

Klaus Schwab, Founder of the

World Economic Forum , raises the ultimate question “

What kind of capitalism do we want? That may be the defining question of our era”. Are we bold enough to answer that question honestly? The answer surely means changing the systems that have led us to where we are today. Technology companies, in particular, can no longer operate with invisibility, or in a vacuum. They are, increasingly, social organisms that have wide-ranging impacts on the lives of the global population.

From executives at Davos to environmentalists at non-profit groups such as the World Wide Fund for Nature, short-termism is getting bad press in recent years. The frustration is unsurprising given the evidence of how bad it is for business. In 2020, for example, the

CFA Institute , the association for investment management professionals, estimated the cost of short-termism at

$79.1bn a year in forgone earnings . Three years earlier the

McKinsey Global Institute found that ‘long-term firms’ had 47% stronger cumulative revenue growth, than other firms, and their profits grew 81% more on average. Yet 70% of executives surveyed by McKinsey in 2020 reported that CEOs would sacrifice long-term growth for short-term financial objectives. Unbridled capitalism has a tight grip on our morality, we need to loosen its grip before we succumb to its effects completely.

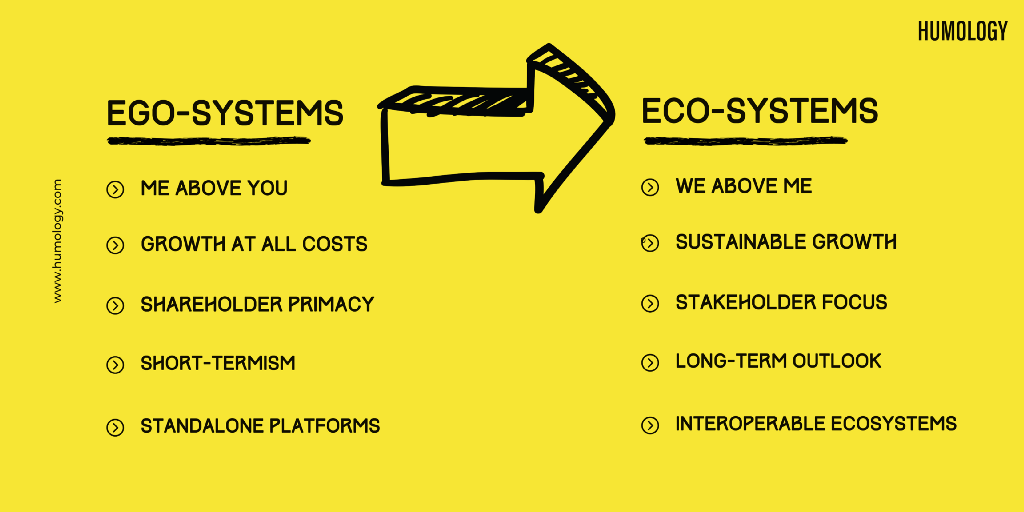

Moving from a short-term outlook to a longer-term focus requires a shift in mindset from ‘

me above you’ to ‘

we above me’ . That means expanding the horizon of the business model to anticipate uncertainty and establish a tolerance to risk, to encompass a broader responsibility beyond shareholder returns, and to have an eco-system mindset to the wider impacts of leading a business in a globalised market. Perhaps, even more importantly, we need to re-examine the metrics we use to evaluate the performance of technology companies to shift towards sustainable and shared value creation that is not extractive to the ecosystem overall.

Leaders must be bold enough to break the mould in order to create a better future. In 2014, Apple announced new climate change and energy goals. When investors challenged CEO Tim Cook to commit to only do climate projects that were clearly profitable, he told them if they didn’t believe in climate change, then they should sell their Apple shares. Cook’s confidence Is backed by impressive statistics. Data shows that long-term-oriented investors deliver superior performance, and long-term-oriented companies outperform in terms of revenue, earnings, and job creation. However, despite a wealth of evidence emphasising the superiority of long-term investments, short-term pressures are difficult to avoid. A majority of corporate executives agree that longer time horizons for business decisions would improve performance, and yet half say they would delay value-creating projects if it would mean missing quarterly earnings targets.

A Way Forward

Author of the Lean Startup,

Eric Ries , is spearheading a way forward for sustainable business models through the creation of the Long-Term Stock Exchange (LTSE). The LTSE is in the same regulatory category as NASDAQ or the NYSE and represents the only other way for companies to go public since the creation of NASDAQ in the ’60s. In order to be listed, companies need to commit to meeting standards that support a philosophy of long-term, multi-stakeholder value-creation. That includes taking care of their employees, their communities, and the environment. Informative public disclosures are also a key pillar of the LTSE ensuring investors are better informed on a company’s long-term strategy. (

Check out Eric Ries discussing his vision on the ZigZag podcast here )

Principles of the LTSE

- Long-term focused companies should consider a broader group of stakeholders and the critical role they play in one another’s success.

- Long-term focused companies should measure success in years and decades and prioritize long-term decision-making.

-

Long-term focused companies should align executive compensation and board compensation with long-term performance.

-

Boards of directors of long-term focused companies should be engaged in and have explicit oversight of long-term strategy.

-

Long-term focused companies should engage with their long-term shareholders.

Asana and Twilio have boldly taken a step towards sustainable growth being the first companies to be listed the LTSE in August 2021. However, the LTSE is just one brick in a new foundation for our civic society. Ultimately, we need to find ways to fund growth-oriented businesses that may not fit the hockey-stick hyper-growth charts valued by traditional venture capitalists. In a company blog titled ‘ We Spent $3.3M Buying Out Investors: Why and How We Did It,’ Buffer CEO and Founder, Joel Gascoigne, outlined his rocky relationship with traditional venture capital investment. Gascoigne details taking the decision to build towards sustainable profitability despite mounting investor pressure to grow the top line aggressively. Sahil Lavingia, founder of Gumroad , shares a similar story about turning his back on hyper-growth in favour of building a sustainable profitable business. “ I am now more focused on creating value than capturing it. I still want to have as large an impact as possible, but I don’t need to create it directly or capture it in the form of revenue and valuation” Lavingia reflects on his journey.

What's Next?

To build a future where humanity and technology co-exist in harmony, we urgently need a radical shift in thinking. I’m talking about a change that starts from the inside out and permeates every decision you take. It starts with answering the question posted by Klaus Schwab: What kind of capitalism do we want? It ends with the customers you serve and the way you serve them. There is no room for compromise and there is no space to think small. The most successful businesses are those that collaborate within their ecosystem and create value for all constituents, rather than extracting value from them.

It’s time for us to stop sacrificing our brains for short-term gains.